Prescribers More Likely to Choose Brands with Automated Processes for Buy-and-Bill Copay Assistance

Medical practices involved in the administration of buy-and-bill medicines face unique challenges, including excessive financial exposure, increased burden on office billing staff, cumbersome processes at the primary payor level, and inventory management control. To make matters worse, copay support programs for buy-and-bill brands have also traditionally relied on cumbersome manual processes. This often results in billing staff going outside the normal workflow, delayed payments, and increased cost to the office.

ConnectiveRx is conducting ongoing survey-based research on the role of automation in buy-and-bill programs with a focus on the needs of two distinct audiences—prescribers and their staff and pharmaceutical manufacturer brand stakeholders. In this article, we report briefly on four of the top-line interim results of the survey, which uncovers the aspects of copay programs that may create favor of one brand over another.

Results sneak peek: automated processes for buy-and-bill copay programs drive better HCP, office staff, and patient experiences. As a result, they create a differentiated benefit to brands that deploy them. By automating the copay assistance process for buy-and-bill brands, marketers can promote faster turnaround times, rapid payments, and greater efficiency for the billing process.

FINDING #1: IN-WORKFLOW PROCESSES ARE PARAMOUNT

We asked respondents to “select the top three attributes you consider the most important in a copay assistance program for a buy-and-bill product.” The leading responses:

- Process fits in workflow for my practice

- Rapid turnaround on claims processing and payments

- Username/password-protected provider portal for enrollment, claim submission, tracking, and reports

Clearly, the days of fax and snail mail are coming to an end. Medical practices prefer to manage buy-and-bill copay programs through digital processes that fit in workflow or can be easily managed through a provider portal. Further, they want fast turnaround on claims submission and payments, which can only be accomplished through technology. In addition to the benefits for practices and patients, automated processes deliver benefits for brands, including automatic data capture, more complete reporting, and better insight into patient adherence.

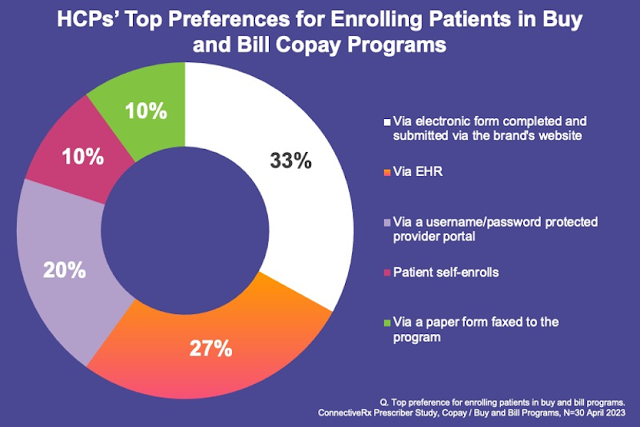

FINDING #2: ENROLLMENT VIA WEBSITE, EHR, OR PORTAL IS PREFERRED

Delving into the specific tasks that must be navigated, we asked respondents to “select your/your practice’s top preference for enrolling patients in a buy-and-bill copay program.” The top three responses were all technology-based:

- Via electronic form completed and submitted via the brand’s website

- Via EHR

- Via a username/password-protected provider portal

Physicians and their team members generally want to take responsibility for enrolling patients in buy-and-bill programs, but they have largely moved beyond faxed paper forms. Instead, they want to enroll patients quickly and efficiently through technological means. While brand website is still the top-rated enrollment channel, EHR is growing in popularity and may soon become the most preferred channel because it is in the practice workflow.

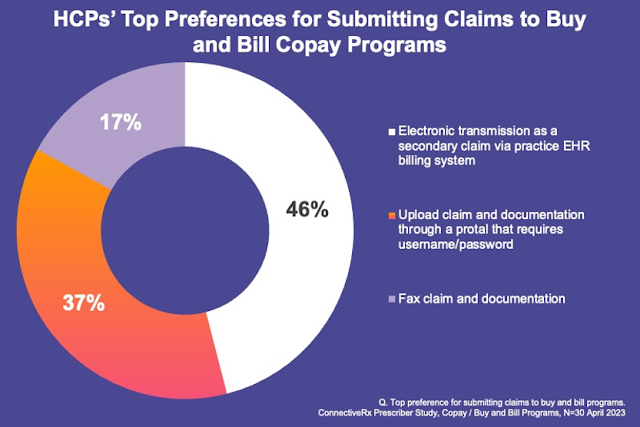

FINDING #3: CLAIM SUBMISSION VIA EHR OR PORTAL IS FAVORED OVER FAX

Focusing on the claim submission process, we asked survey participants to “select your/your practice’s top preference for submitting claims to buy-and-bill copay programs.” And the bad news for fax and snail mail continues. The leading answers:

- Electronic transmission as a secondary claim via practice EHR billing system

- Upload claim and documentation through a portal that requires username and password

As shown in these responses, the vast majority of prescribers and their teams are looking to streamline claim submission through the use of either their EHR or a brand portal.

FINDING #4: TOP PAYMENT PREFERENCE IS DIRECT DEPOSIT TO THE PRACTICE’S BANK ACCOUNT

Finally, we asked respondents to “select your/your practice’s one preferred method for receiving payment for buy-and-bill copay program claims.” The number one answer, with 50% of responses, was “direct deposit of the payment to the practice’s bank account.” Unsurprisingly, the most technologically advanced and fastest payment method wins the day.

Interestingly, the #2 answer was “patient pays up front and seeks reimbursement from the copay program.” This is an intriguing response, since it suggests that as many as 25% of provider offices may be willing to let patients manage the financial exposure inherent in buy-and-bill programs. It will be interesting to see how this plays out as we collect and interpret the final results of this important research.

As shown in the responses to these survey questions, medical practices are eager to adopt automated processes across multiple aspects of copay programs, including enrollment, claim submission, and payment processing. Speed of reimbursement is mission critical and is the most important driver of automation. Providing the path of least resistance and fitting in the office workflow can ultimately drive usage of a brand. Digital processes do more than just benefit provider offices. They can help patients get on and stay on crucial specialty medications.

A WINNING STRATEGY: AUTOMATED BUY-AND-BILL COPAY ASSISTANCE

As the industry trends toward electronic processes throughout the patient/provider journey, it is important that copay assistance programs keep pace. When electronic benefits verification (eBV) and electronic prior authorization (ePA) are combined with electronic copay claim submission and payments, both speed to therapy and speed to payment are increased dramatically. This combination can demonstrably increase satisfaction among prescribers, office staff, and patients.